Good Corporate Governance

Management Guidelines

1.Policy

The Board of Directors and Management consistently emphasize and adhere to guidelines and controls under corporate governance. The company fosters awareness of corporate governance and the business code of conduct among employees at all levels, in order to build an organization with an effective management system, add value, and encourage sustainable growth. The company communicates corporate governance guidelines to all employees through the issuance of an employee handbook from their first day of work. This ensures that employees adhere to ethical principles, honesty, responsibilities, and transparency when dealing with stakeholders such as customers, business partners, competitors, shareholders, society, employees, and colleagues. The policy aligns with the new edition of the 2017 good corporate governance principles distributed by the SET (Stock Exchange of Thailand) as guidelines for listed companies. These guidelines are appropriate for the changing business environment. The policy is divided into eight sections as follows:

1. Awareness of the roles and responsibilities of the Board of Directors in sustaining the company’s value.

2. Setting objectives for sustainable growth.

3. Building an effective Board of Directors.

4. Recruiting and developing senior executives and managing personnel.

5. Supporting innovation and conducting business with responsibilities.

6. Implementing appropriate risk management and internal control.

7. Maintaining credibility in terms of finance and information disclosure.

8. Encouraging involvement and communication with shareholders.

2. Responsible Units (Board Level and Responsibilities)

The Board of Directors plays a crucial role in determining the organization’s vision, strategies, policies, and operational plans, as well as considering risks that may arise at the organizational level. They are responsible for aligning the appropriate management approach with the business operations, as well as establishing reliable accounting systems, financial reporting, and auditing practices.

The company’s Board of Directors consists of five sub-committees, namely the Audit Committee, Nomination Committee, Remuneration Committee, Corporate Governance and Sustainable Development Committee, and Risk Management Committee.

The Audit Committee serves as an independent entity that supports and assists the company’s Board of Directors in fulfilling their responsibilities related to examining the accuracy of financial information presented to shareholders and other stakeholders. It audits the effectiveness of internal control systems, internal audit processes, and compliance with laws, regulations of the Stock Exchange of Thailand, and other supervisory agencies to ensure proper governance.

The Nomination Committee is responsible for selecting individuals with suitable qualifications to serve as high-level executives and board members, aiming to ensure transparency in the selection process. Additionally, it focuses on enhancing the knowledge and capabilities of the board members to align with the business needs and instill confidence in shareholders regarding the appointment of individuals who possess the qualifications and potential to safeguard the company’s interests.

Criteria and process for recruiting managing directors

The Remuneration Committee’s responsibilities include considering the remuneration for the Board of Directors, sub-committees, executives, and senior executives. This process is carried out with fairness, reasonableness, and in accordance with good corporate governance principles. Its aim is to instill confidence in shareholders and stakeholders.

The Corporate Governance and Sustainable Development Committee’s role is to support and assist the company’s Board of Directors in formulating and establishing policies related to corporate governance and implementing appropriate practices throughout various areas of the company. This is done with transparency, in line with good corporate governance principles and business ethics, aiming to inspire confidence and trust among shareholders, investors, stakeholders, and all parties involved. The objective is to create value for the company and facilitate sustainable growth.

The Risk Management Committee’s role is to provide support and carry out duties on behalf of the company’s Board of Directors, based on the fundamental principles of good corporate governance. This includes aligning with the company’s vision, mission, and goals, as well as establishing a framework for enterprise risk management in accordance with the COSO Enterprise Risk Management Framework (COSO ERM). It also involves promoting and supporting comprehensive risk management throughout the organization and embedding it as part of the company’s culture. All of these efforts aim to instill confidence and assurance among stakeholders that strategic operations are directed towards efficiently and effectively achieving the company’s objectives and targets.

3. Processes and Management Systems

The company has recognized the importance of good corporate governance and has consistently taken steps to promote and adhere to the principles of good corporate governance. This commitment is beneficial for the sustainable operation of the company as it demonstrates high standards of business management. It enhances the company’s reputation and acceptance both domestically and internationally. Additionally, it fosters transparency and efficiency within the management, instilling confidence among shareholders, investors, and stakeholders. The company also emphasizes a strong commitment to social responsibility and the overall benefits to society and the nation.

The Board of Directors has leadership qualities, a vision, and the autonomy to make decisions for the overall benefit of the company and its shareholders. The board actively participates in defining and approving the vision, strategies, objectives, business plans, and budgets of the company. They also provide guidance and oversight to ensure that the management executes the business plan and budget efficiently and effectively. Both the board and the management have a responsibility towards the shareholders. Currently, the company’s board of directors consists of five subcommittees: the Audit Committee, the Nomination Committee, the Remuneration Committee, the Corporate Governance and Sustainable Development Committee, and the Risk Management Committee. These subcommittees have different structures, qualifications, roles, responsibilities, and levels of accountability.

The independent committee is a part of the company’s Board of Directors, which consists of at least one-third of the total number of directors and a minimum of three individuals. According to the principles of good corporate governance, the proportion of independent directors must be more than half of the total number of directors in the following cases:

a) The chairman of the board and the CEO are the same person.

b) The chairman of the board is not an independent director.

c) The chairman of the board and the CEO are individuals within the same family.

d) The chairman of the board is a member of the management board or a working group or has been assigned responsibilities in the management area.

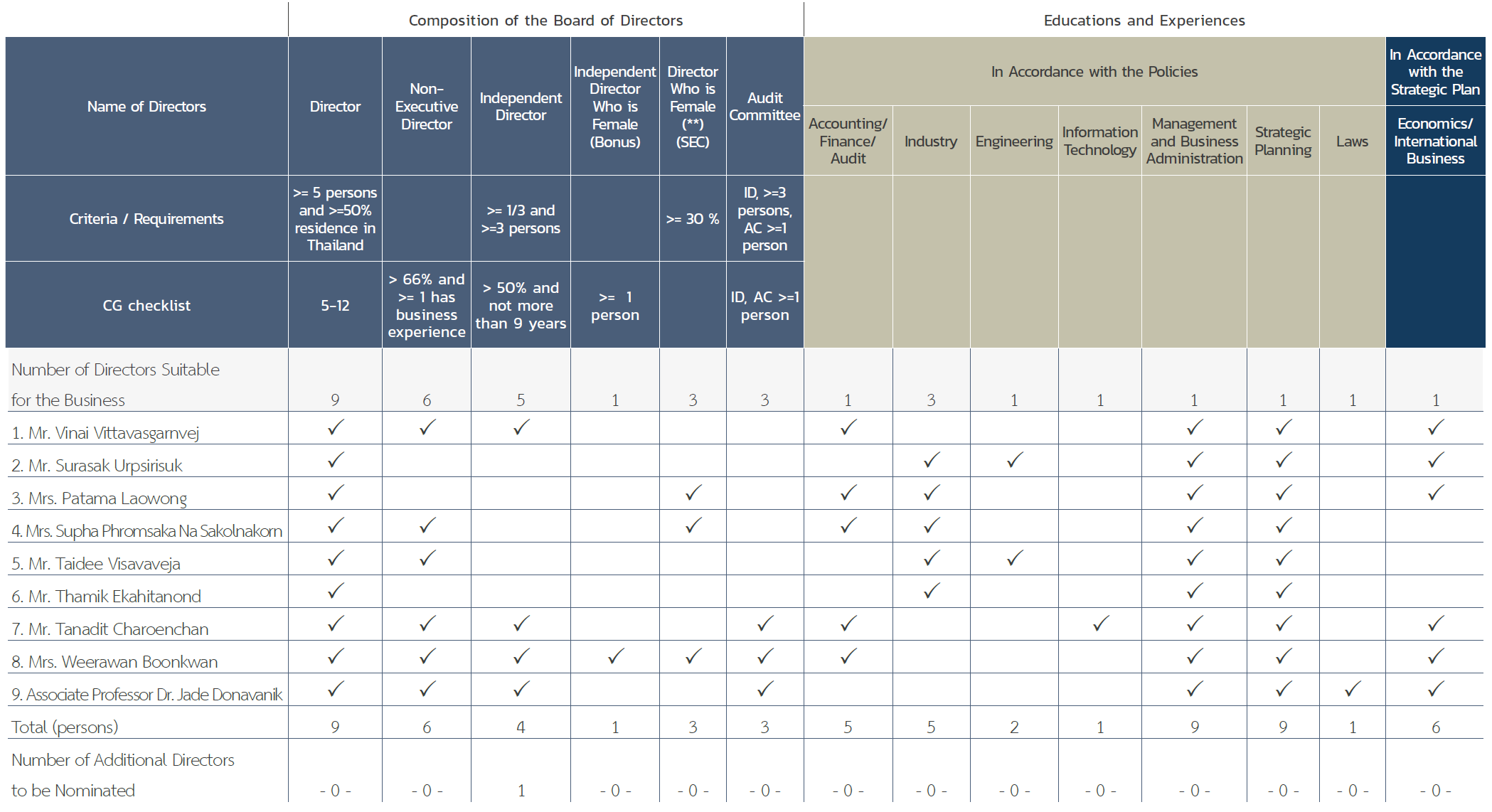

Currently, the company has four independent directors, with three of them serving as audit committee members. The chairman of the company is an independent director who does not fall under the criteria set by the Securities and Exchange Commission (SEC). Therefore, the company is not required to have a proportion of independent directors greater than half of the total number of directors. However, in order to adhere to the principles of good corporate governance, the company has implemented a policy regarding the composition of the Board of Directors through a Board Skill Matrix, which aims to increase the number of independent directors to at least half of the total number of directors.

Structure, Qualifications, Roles, Responsibilities, and Accountability

Board of Directors Charter

Audit Committee Charter

Nomination Committee Charter

Remuneration Committee Charter

Corporate Governance and Sustainable Development Committee Charter

Risk Management Committee Charter

Diversity Policy

Diversity Policy

The structure and composition of the Board of Directors should be appropriate for the size, type, and complexity of the business. The qualifications of the directors should align with the skills, experience, and specific expertise relevant to the company’s industry or core operations. A Board Skill Matrix is developed to facilitate the selection process of directors, ensuring alignment with the company’s business direction.

Board Skill Matrix

The Results of the Performance

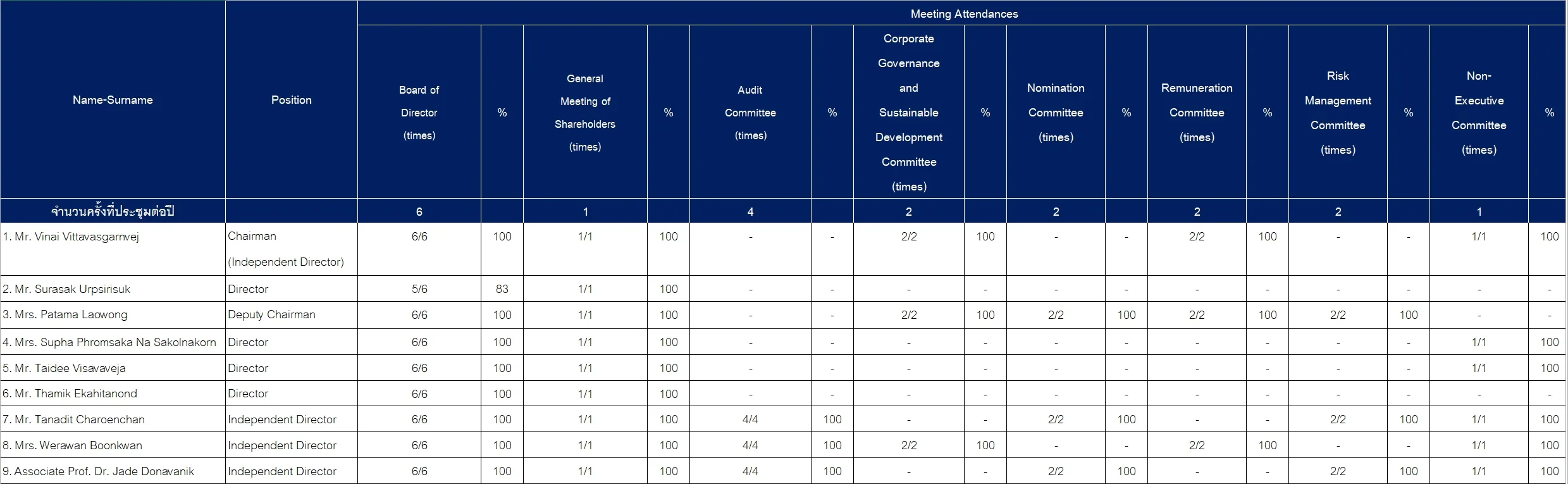

The meeting attendance of the Board of Directors and the Sub-committees can be summarized as follows :

The meeting attendance of the Board of Directors and the Sub-committees can be summarized as follows :